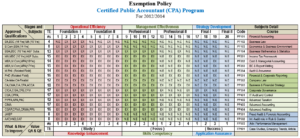

Exemption Policy

Your previous qualifications may entitle you to exemptions from certain CPA examinations. This will ensure that your point of entry is the most suitable for your level of knowledge and skills and will prevent you repeating areas with which you are already familiar. This database shows many of the qualifications which can be accepted for exemption. Students are advised to monitor the database regularly as CPA’s exemption policy is subject to change and assessments may be added or revised without prior notice.

Holders of recognized business and/or accounting diplomas/degrees will be considered for exemptions from some or all of the CPA exams. Student with non-relevant degrees will be dealt case to case basis.

Exemption is only considered on the basis of qualifications which contain relevant content to CPA papers.

PAC Exemption Policy

| Subject Code | Subject | 12 Year Education |

14 Year Education |

| Foundation Level I | |||

| F101 | Functional English | N.Exempt | Exempt |

| F102 | Business Finance | N.Exempt | Exempt |

| F103 | Principles of Accounting | N.Exempt | Exempt |

| F104 | Economics and Business Environment | N.Exempt | Exempt |

| F105 | IT | N.Exempt | Exempt |

| Foundation Level II | |||

| F201 | Business Mathematics and Statistics | N.Exempt | Exempt |

| F202 | Financial Accounting | N.Exempt | Exempt |

| F203 | Cost and Managerial Accounting | N.Exempt | Exempt |

| F204 | Islamic and Pakistan Studies | N.Exempt | Exempt |

| F205 | BC & Presentation Skills | N.Exempt | Exempt |

| Foundation Level III | |||

| F301 | Business Law | N.Exempt | Exempt |

| F302 | Income Tax | N.Exempt | Exempt |

| F303 | Audit and Assurance | N.Exempt | Exempt |

| F304 | Advanced Managerial Accounting | N.Exempt | Exempt |

| F305 | Certificate in Data Analysis | N.Exempt | N.Exempt |

| Foundation Level IV | |||

| F401 | Enterprise Management | N.Exempt | Exempt |

| F402 | Financial Management | N.Exempt | N.Exempt |

| F403 | MIS | N.Exempt | N.Exempt |

| F404 | Company Law | N.Exempt | N. Exempt |

| F405 | Fraud Audit and Forensic Accounting | N.Exempt | N.Exempt |

| Total Exemptions | 0 | 15 | |

- No exemption is available for 12 Years of education

- Just 5 Exams for 14 Year of Education applicants depending on their field of study

- 14 Year education students can get 15 exemptions and go for the passing remaining subjects for PAC certificate but they cannot go for CPA after PAC. The route for them is to qualify PPA and then apply for new evaluation for CPA program.

CPA after PAC Exemption Policy

- No exemption for PAC qualified in CPA subjects. They have to appear in all 9 subjects to complete the CPA.

- No entry for 14 year Graduates/ 16 Year Education in CPA after PAC.

PPA Exemption Policy

|

Subject Code |

Subject |

14 Year Education |

16 Year Education |

| Foundation Level I | |||

| D101 | Foundations of Accounting | Exempt | Exempt |

| D102 | Fundamentals of Business Law | Exempt | Exempt |

| D103 | Business Environment | Exempt | Exempt |

| D104 | BCRW | Exempt | Exempt |

| Foundation Level II | |||

| D201 | Financial Accounting | Exempt | Exempt |

| D202 | Income Tax | N.Exempt | Exempt |

| D203 | Cost Accounting | N.Exempt | Exempt |

| D204 | Information Systems | N.Exempt | Exempt |

| Foundation Level III | |||

| D301 | Business and Managerial Finance | N.Exempt | Exempt |

| D302 | Auditing | N.Exempt | Exempt |

| D303 | Financial and Corporate Reporting | N.Exempt | N.Exempt |

| D304 | Strategy and Leadership | N.Exempt | Exempt |

| D305 | Management Accounting | N.Exempt | N.Exempt |

| Foundation Level IV | |||

| D401 | Audit Practice and Assurance Services | N.Exempt | N.Exempt |

| D402 | IT Audit and Control | N.Exempt | N.Exempt |

| D403 | Company Law | N.Exempt | N.Exempt |

| D404 | Advanced Taxation | N.Exempt | N. Exempt |

| D405 | Fraud Audit and Forensic Accounting | N.Exempt | N.Exempt |

| Total Exemptions | 5 | 11 | |

5 Subjects are exempt for 14 Year Education Students in PPA.

11 Subjects are exempt for 16 Year Education students in PPA.

If anyone claims for more exemptions, then the subject course will be evaluated and exemption will be given only if 70% subject’s course material is identical.

Exemptions can be claimed on the basis of experience (if the experience in related field is less than 5 Years), because for professionals the entry route is CPA General Route.

CPA after PPA Exemption Policy

- No exemption for PPA qualified in CPA subjects. They have to appear in all 6 subjects to complete the CPA.

- No entry is possible without PPA in CPA after PPA.

- Relevant experienced professionals between 1-5 years can claim for more exemptions

- Professional certificate holders can claim for exemptions, the exemption criteria will vary from case to case.

CPA Professional Exemption Policy

|

Subject Code |

Subject |

14 Year Education |

16 Year Education |

| Foundation Level I | |||

| PF101 | Financial Accounting | Exempt | Exempt |

| PF102 | Business Law | Exempt | Exempt |

| PF103 | Economics and Business Environment | Exempt | Exempt |

| PF104 | Business Mathematics and statistics | Exempt | Exempt |

| Foundation Level II | |||

| PF201 | Income Tax | Exempt | Exempt |

| PF202 | Cost and Managerial Accounting | N.Exempt | Exempt |

| PF203 | BCRW | N.Exempt | Exempt |

| PF204 | Audit and Assurance | N.Exempt | Exempt |

| Professional Level I | |||

| PP301 | Financial and Corporate Reporting | N.Exempt | Exempt |

| PP302 | Company Law | N.Exempt | Exempt |

| PP303 | Business and Financial Strategy | N.Exempt | Exempt |

| Professional Level II | |||

| PP401 | IT audit and Control | N.Exempt | N.Exempt |

| PP402 | Advanced Taxation | N.Exempt | N.Exempt |

| PP403 | Advanced Accounting | N.Exempt | N.Exempt |

| FP501 | Fraud Audit and Forensic Accounting | N.Exempt | N.Exempt |

| FP502 | Internal audit role in risk and control | N.Exempt | N.Exempt |

| FP503 | Advanced Performance Management | N.Exempt | N.Exempt |

| FP504 | Advanced Audit | N.Exempt | N.Exempt |

| Total Exemptions | 5 | 11 | |

- Entrance is only for Experienced Professionals (Minimum 5 years Experience in related field)

- PAC and PPA certified cannot enter in this route

- Graduates with experience will have to appear in 13 Exams to qualify for CPA

- 16 years Education with experience will have to appear in 7 Exams

- More exemptions can be claimed depending on field of experience and professional certificate holders

- Professional certificate holders can claim for exemptions, the exemption criteria will vary from case to case

- The above subjects’ arrangement revised as per detail given under Curriculum Tab.