About Our Qualified CPAs

Our qualified Certified Public Accountants (CPA) are innovative and strategic thinkers who are well respected for their integrity and commitment to excellence. They are dedicated to each client and work to satisfy their business and financial needs. Our Certified Public Accountants (CPAs) act as advisers to individuals, businesses, financial institutions, nonprofit organizations and government agencies on a wide range of financial matters. Today, many individuals and businesses turn to CPAs for help with tax preparation, personal financial planning, auditing services, and advice on developing effective accounting systems.

Our qualified CPAs are no longer just number crunchers and tax preparers. They are business and financial strategists who help chart the paths of businesses and individuals. Individuals turn to their CPAs for tax and financial planning services, investment advice, estate planning, and more.

Businesses are tapping our CPAs to not only manage finances and taxes, but also to determine profitable new product lines, help diversify investments, and provide a variety of other consulting and business services.

Our members have to fulfill the following requirements to use the CPA designation:

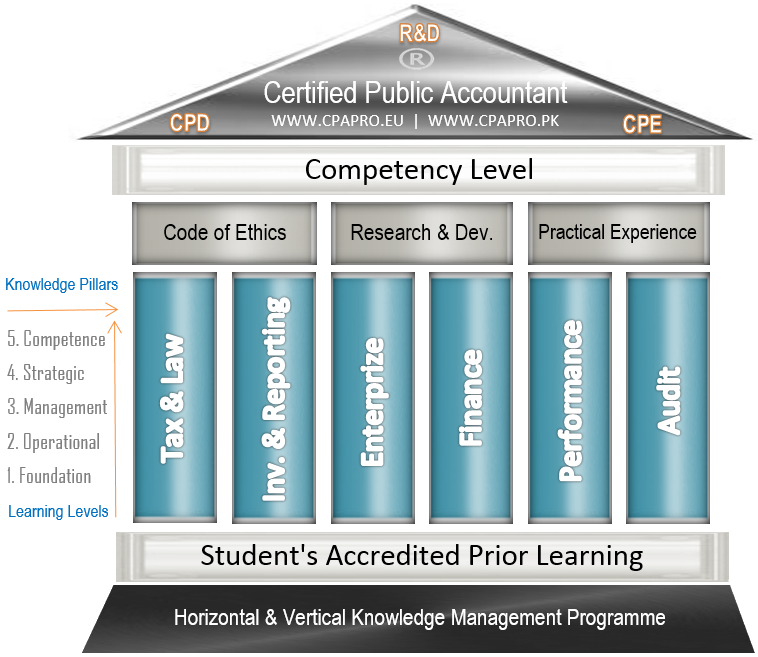

1. Complete a 14 years university degree or a duly recognized postgraduate academic qualification

2. Complete the CPA Professional 150 Credit Hours’ Program of five Learning Levels or five Knowledge Pillars,

3. Complete three years of professional experience in finance, accounting or business related field

4. Ensure the competency level set by the association

5. Comply to a strict code of ethics and professional conduct

6. Undergo CPD activities duly approved by the association each year